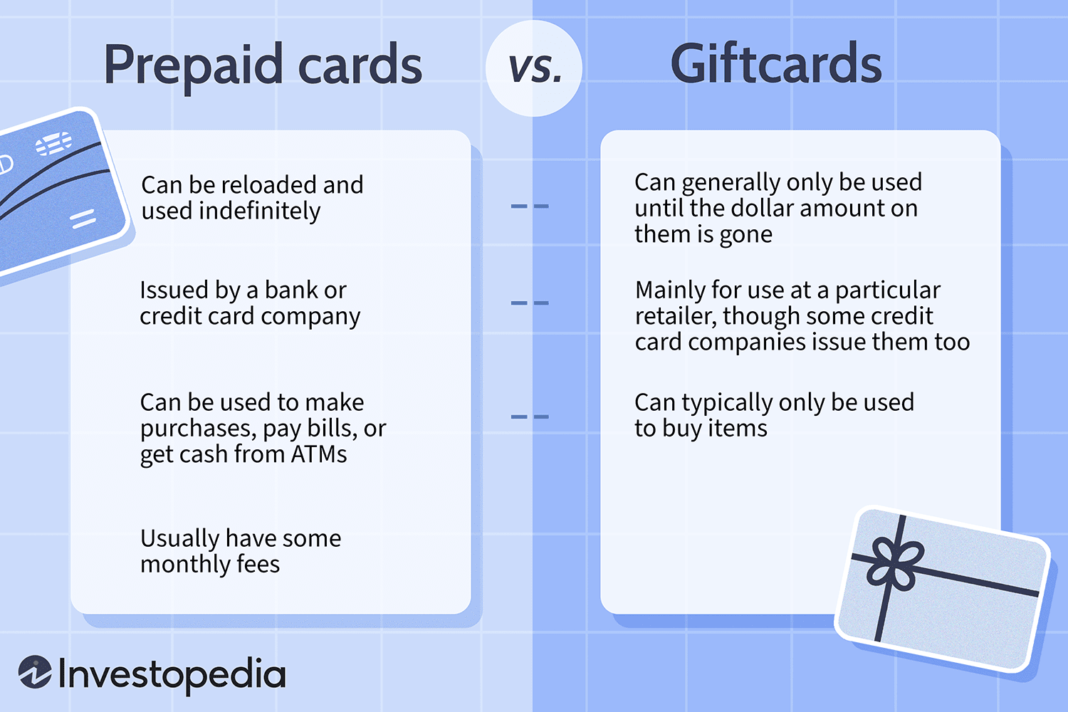

Prepaid cards are popular because they can help consumers manage their finances. The cards have some benefits and downsides that you should be aware of before you commit to using one.

Prepaid cards appeal to consumers because they can use them to make purchases without worrying about overspending. While it is easy to spend more available, prepaid cards prevent this by only allowing a person to finish what’s on the card. There are no credit check requirements and no interest charges, as well as no minimum balance requirements or fees for monthly statements or annual account maintenance fees.

Here are a few things to learn about prepaid cards:

Prepaid cards have fewer credit scores.

If anyone tends to carry balances or revolve debt, the interest paid on revolving credit will be less expensive than the monthly fees that accrue on a prepaid card.

Consumers primarily use credit cards with good credit scores who can afford to pay off their monthly balances. Consumers generally use prepaid cards with less-than-stellar credit scores and want control over their spending.

For people who have good credit and plan on paying off their monthly balance, it’s best to apply for a traditional bank account or line of credit rather than a prepaid card.

Prepaid cards have less fraud protection.

As mentioned above, prepaid cards offer less fraud protection than traditional debit or credit cards. Fraud protection is one of the main reasons people use these types of cards over other payment methods. In addition, prepaid cards have less fraud protection than traditional debit or credit cards.

This is because when people purchase with cash, there’s no record of the transaction. So if someone steals their purse and uses the money to buy something, nothing stops them from doing so.

Credit card companies know about this vulnerability and try to protect their customers by implementing various security measures like extra layers of authentication before allowing purchases to go through or requiring personal information such as date of birth on every purchase, even when using online shopping sites.

But there are some downsides to using a prepaid card.

While prepaid cards are an excellent option for some people, there are some downsides. The most obvious is that no one can build credit using a prepaid card.

Another potential downside is that prepaid cards have higher fees than regular credit cards. For example, if someone is late with a payment on their prepaid card and the company charges them a fee, it becomes difficult to find out how much that cost would be or what caused it in the first place.

Then there’s the issue of fraud protection: Because these cards are designed for people without bank accounts which often make small purchases online or in-person at businesses where fraud is common, in-person security features make them more susceptible to identity theft than other types of payment methods.

No credit line on a prepaid card

There is no credit line on a prepaid card, which means you don’t get to build credit.

If someone wants to build credit, prepaid cards aren’t the way to go. Most of the time, these services don’t give a credit limit. It depends on paying bills on time. This is not going to help build a reputation.

If someone needs money in an emergency and has no other options but to use a prepaid card or check-cashing service, then it might be worth looking into one of those alternatives as long as they don’t charge too much or require any collateral.

Conclusion

As with any financial decision, there are pros and cons to using a prepaid card. This may be the solution if someone is looking for an easy way to stick to their budget without having access to overdraft protection. But if building credit or having fraud protection is essential, consider how other alternatives might fit into their financial goals before signing up for one of these cards. Prepaid cards can be a good option if they’re adequately used; make sure to know what those limitations are so that it doesn’t end up costing more than anticipated when it comes time to spend money.