Many people today try to exchange currencies, but they do so as a part-time job and not as a full-time job. The income they get from forex is treated as additional income, but not as the main source of income. Do you know why I would say it is because they don’t really understand what exactly is currency trading? Currency transactions do not provide exactly the same income each month, sometimes they even lose their total capital. Some people don’t even think that currency trading can be a perfect business. They thought that currency trading was like playing. It is a high and speculative risk. They believed that winning was only the beginning of losing even more capital. All of these thoughts are correct if you don’t really understand what currency trading is and how to control it.

Currency trading is not for everyone. It really is a high risk job. Still, it may be his full-time business that gives him a lot of freedom to enjoy his life instead of 6 p.m. The good news is that currency trading can provide you with a good income as a source of life. If you’re smart, don’t be surprised that your income is unlimited.

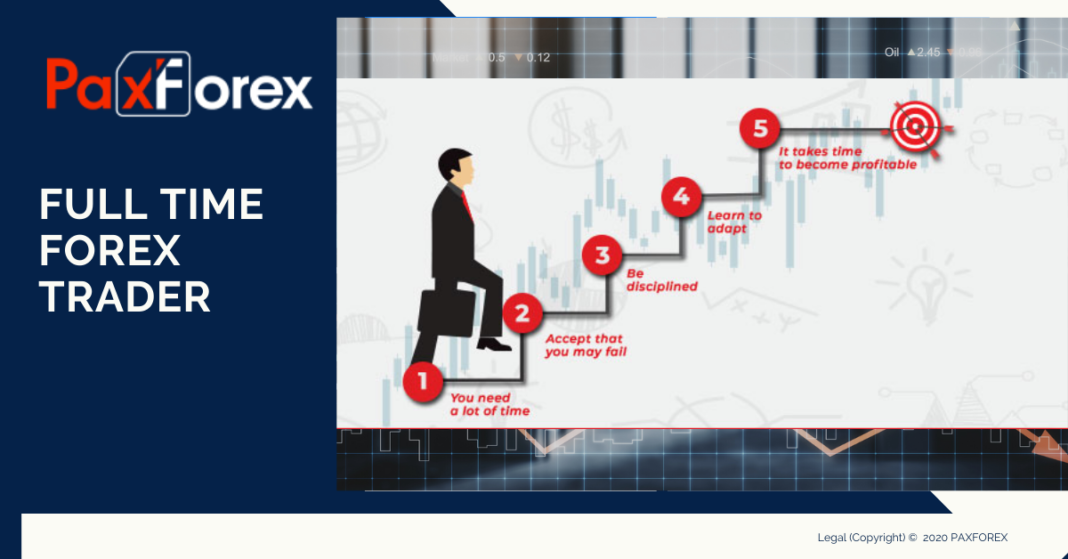

To become a Forex trader, I mean that full time Forex trader, you really need to do your homework. It really takes effort, persistence, and discipline. There are few golden rules that a full-time Forex trader should consider as follows:

1. A good trader must be able to master his psychology.

A winning merchant thinks differently! A good trader must be able to control his greed and fear. You should be able to accept all losses. It is best to stop each transaction to find out how much money you will lose if the administration is against you. If you lose, don’t be surprised or disappointed. It may be time to stop working for a few days. Sit back and watch the market to see what’s really going on. Wait until you know the direction of the market and be reasonably sure of the currency of your chosen pair, then you can start trading again. A smart trader does not have to trade every day or trade more than once a day.

2. A good trader is more concerned with the quality of each trade.

The confidence of an operator does not rest on the result of an operation, but on a coherent implementation of inputs and outputs. This ensures that the gains cover the losses.

3. A good dealer always does his homework.

What is the merchant’s job? The task is to create a series of magazines that include market analysis throughout the week. You can do it on weekends to see the market trends from last week. Prepare for what you want to do at the start of the new week. How were the market trends? What is the address on the market next week? Some people depend on another party for this task. They simply wait for the new email to arrive in the inbox of their email account and indicate the forex signals. I’m not saying that all forex signals are misleading. There are no specific forex signals. People could only make a few predictions. Their forecasts are, of course, based on a market assessment based on their own analyzes and experiences. There are no straight forex signals between them. There are no good or bad signs. These are all predictions. I just think that each operator can do their own analysis as long as they are ready to spend time assessing the market. They can be your own market analyst. This skill requires trial and error. The more you control, the better you are.

How to become a successful Forex trader

It is about buying and selling currency on the Internet. While a particular currency must be valued against another currency, the trader must buy that currency. Even if a currency is to be exchanged for another currency, the merchant must sell that currency.

The rewards can be great, but there is a learning curve to follow. Currency trading requires the skills and knowledge to adapt to the style of fast trading. As a novice Forex trader, capital is no longer a trading problem. You can start small and gain experience. About 90% of Forex traders are tech traders, they rely on charts to detect technical trading queues. Some people adopt basic business signals like press releases, financial trends, cash news, etc. Few of them combine their technical systems with the basic elements mentioned in Forex training. If you want to become a Forex trader to participate in Forex trading, you can get many tools and help yourself with many online Forex course tutorials to get started. However, it is easy to study how to make money through currency trading, but it is not easy to be successful.

When trading Forex, one should be aware of the risks associated with trading without knowing it. The decision to make a transaction should be made randomly after the rules for developing the strategy have been established. After building the strategy, the operator should practice following the strategy because, as a beginner, the strategy may be lost when an operation is entered. You can accelerate your learning skills by taking an integrated currency trading course from a mentor who wants to share his secrets and techniques. Acquiring comprehensive training in Forex Trading is all you need to be successful in online currency trading. Learning Forex with a mentor is important to make money as a currency trader.