A business loan is a perfect option if you’re looking for funding to grow your business or a little extra for your daily cash flow needs. But before you get your business loan, lenders will assess your creditworthiness to ensure you can repay the amount, and for this, they require collateral. Collateral is one form of security for lenders. However, unlike the other requirements, such as credit history, profits, reputation, you can pick and choose the collateral you’re willing to put up. Here’s a list of assets you can place as collateral for a business loan.

1. Real Estate

One of the most common forms of collateral for a secured business loan is real estate. One of the reasons for its popularity and easier approval is that real estate has value and tends to appreciate over time. For business loans, when you place real estate as security, you can put up equities of property, commercial property, or personal property.

However, it’s good to keep the consequences of putting your property up as security in mind. In the unfortunate situation of your business going under or repeated defaults on your loan, the lender can seize the property.

2. Equipment

As with property or a car, equipment also acts as the collateral to back your loan. If your business owns items like vehicles, machinery, or other tools, as part of the inventory, you can put that up as security. But with equipment, the loan amount may be lesser than real estate, considering the cost of equipment is significantly lower. Again, as with real estate, in case you default, the lender can repossess your equipment. It’s best you check all details, terms and conditions like business loan interest rates, EMIs, etc. before going ahead.

3. Inventory

Typically, for product-based businesses, you can secure a loan with the help of the inventory you have. Before accepting your inventory as collateral, the lender appoints someone from their in-house team or a third party to physically appraise the value of your inventory.

Most often, lenders are hesitant to accept inventory as collateral, as the chances of selling it to amass the money can be a challenge. You can always use the business loan EMI calculator to check your EMIs and avoid such a situation.

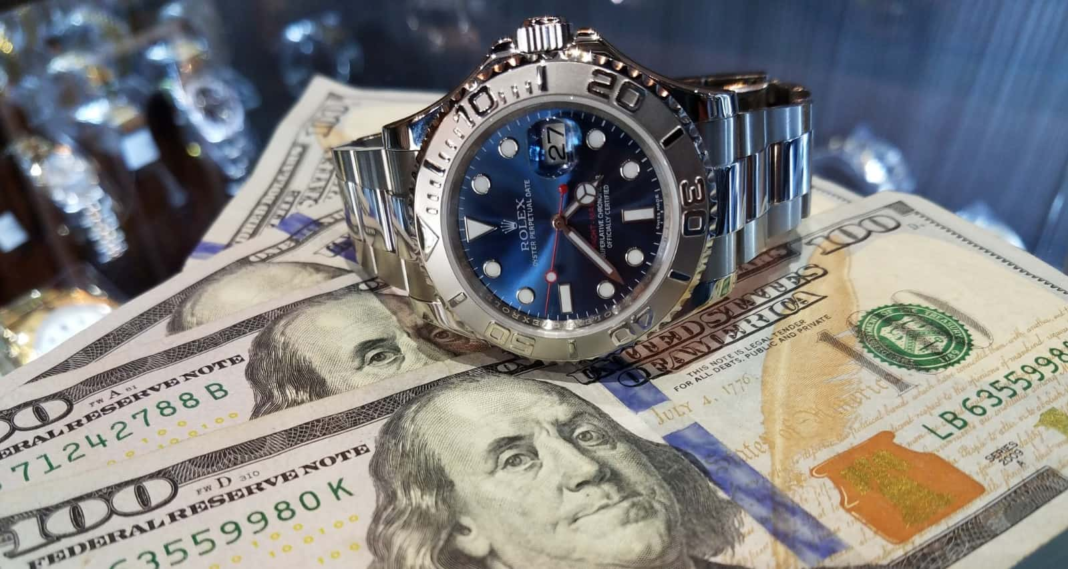

4. Investment, jewelry, and other valuables

When you don’t have any of the above, you can always count on personal investments such as bond investments, mutual funds, stocks, etc. to secure a business loan. Some lenders even accept collectible antiques, fine art, and gold jewelry. Typically, any liquid asset that you can quickly sell to repay lenders. The only catch with this form of collateral is that its value keeps fluctuating.

What you use as collateral entirely depends on your business and its needs. Just remember, a business loan always comes in handy when you need a little extra capital to grow your organization. Check your business loan eligibility today, apply and reap unlimited benefits!